For 28 years, Interac has been synonymous with debit acceptance in Canada. Canadians rely on Interac 12 million times a day to pay, be paid, withdraw cash and transfer funds electronically. But despite enjoying near universal brand recognition, consumers struggled to explain what Interac is or what it does.

As a result of relentless spending from Interac's behemoth competitors Visa, Mastercard and Amex, the Interac brand had been experiencing a year-over-year trend of decreasing share of mind leading up to the year 2014. It had to act as a matter of survival. It needed to define its role in the minds of consumers and reinvent itself with a meaningful point of view that would give Interac leverage in an increasingly cluttered payment space.

And so in the spring of 2014, Interac successfully launched a new brand campaign rooted in the idea that life is better when you use your own money. Agency Zulu Alpha Kilo coined the phrase "Be in the Black" as a memorable rallying cry for Canadians to be financially responsible, to use their own money by choosing their Interac card instead of their credit card, and feel amazing for doing so.

The goal for 2015 was to continue to leverage the "Be in the Black" brand platform in novels ways that would strike a deep emotional chord with Canadians and position Interac as their ally. With no new product development or offering, the team needed the brand advertising to do the heavy lifting. The agency needed to help improve advertising awareness, brand link, relevance and motivation.

Specifically, Interac wanted to achieve a 5% lift in brand awareness in 2015.

In order to have any real impact, the agency knew the brand had to get consumers thinking about Interac as an intentional choice – the 'feel better' choice – when they opened up their wallets to pay for something.

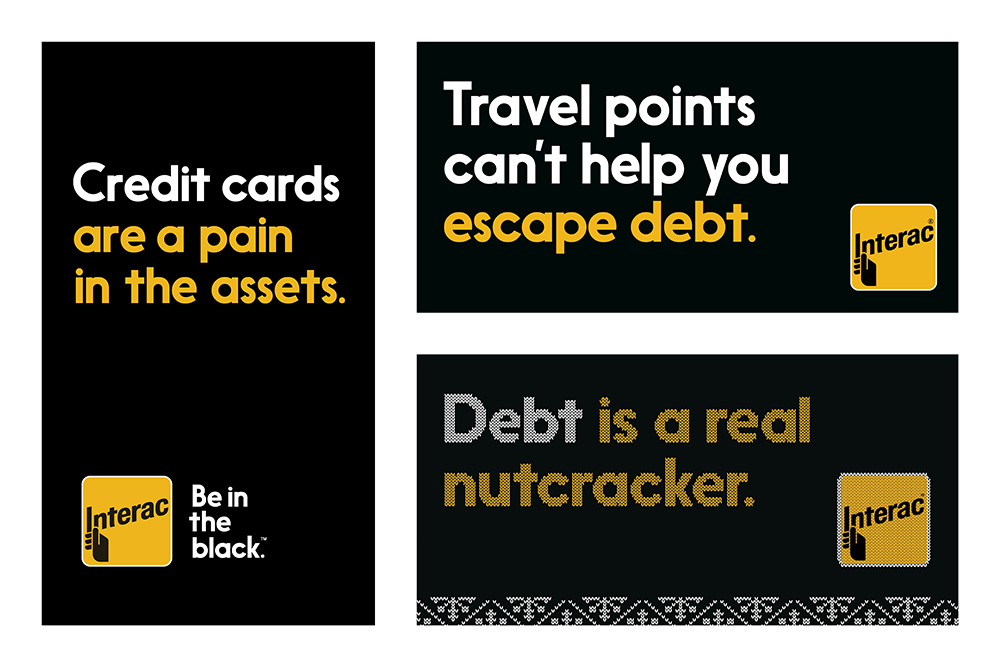

The agency re-deployed hard-hitting proximity OOH against key retail verticals, and used digital and five-second TV bumper executions to remind Canadians to avoid the stress of debt by using Interac Debit instead of credit. Headlines here included "Credit cards are a pain in the assets," "Don't borrow from tomorrow" and "Travel points can't help you escape debt."

Zulu Alpha Kilo teamed up with reality TV star Gail VazOxlade to launch a content-driven program to help wean Canadians off their credit card addiction. As one of Canada's most well known personal financial experts and the star of Slice's "Til Debt Do Us Part", Gail was the perfect voice for the program. For the Quebec market, the team chose French Canadian financial expert, Fabien Major.

The program included 23 pieces of bite-sized video content including an introduction to the challenge, a video for each day of the challenge, and a closing congratulatory message. The online videos presented tips and tricks for living debt free – from separating needs from wants to avoiding unwanted automatic increases in credit card interest rates.

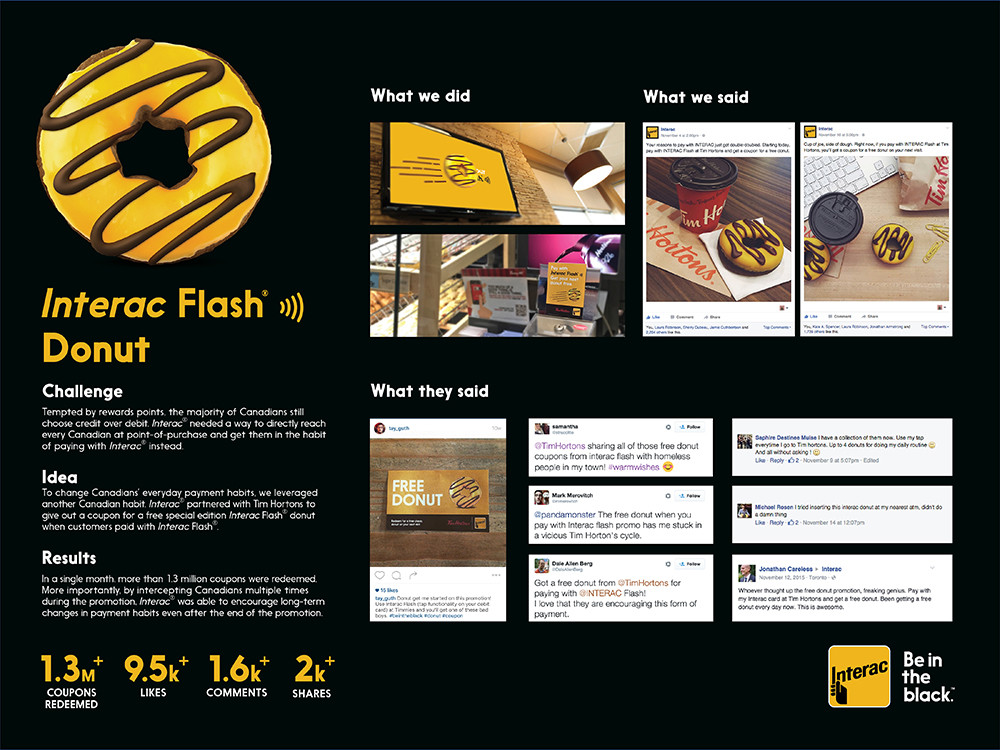

To further drive transaction volume, the agency also launched a series of Instant Gratification programs with key Canadian retailers including Cineplex, The Beer Store, Pizza Nova, Sobeys and Tim Horton's. It also used contests to help generate huge numbers of Interac Debit transactions for smaller merchants. In the summer, the brand partnered with Summerlicious to bring an exclusive contest to Toronto foodies. Customers who paid with Interac Debit could enter for a chance to win a private dinner with celebrity chef Susar Lee.

And finally, to help Canadians avoid the January blues that come with a huge post holiday bill, the agency developed the "Merry January" campaign to remind Canadians there's a stress-free way to buy during the holiday season with Interac Debit card instead of credit.

At the centre of the campaign was a richly cinematic film that features a last-minute holiday shopper whose imagination runs wild in a toy store. At the exact moment the woman reaches for her credit card, the inanimate toys in the store come to life and warn her of the perils of credit card debt. To the tune of Tchaikovsky's "Dance of the Sugar Plum Fairy." the toys sing "Debt, debt, debt, debt, debt." Once back to reality, the shopper wisely decides to use her own money instead of credit, and pays with the convenience of her Interac Debit card. Additional online videos featured a festive, Griswold-like family putting a twist on two traditional carols: "Don't debt the halls with credit follies' and 'We wish you a Merry January". The campaign also included out-of-home, print and digital executions with the headlines: "Debt is a real nutcracker"; "You're a foul one, Mr. Debt"; "Credit Card Fees? Humbug"; and "Sleigh interest fees".

Throughout the campaign, there was strong evidence the advertising broke through and impacted perceptions and behaviour.

Awareness for Interac increased by 50% from pre-launch levels and outperformed key credit card rivals.

Not only was awareness strong, consumers were correctly associating the advertising with Interac. Strong branding cues within the entire "Be in the Black" campaign resulted in strong brand link right from the start, outperforming the Ipsos norm (0.79 vs 0.53).